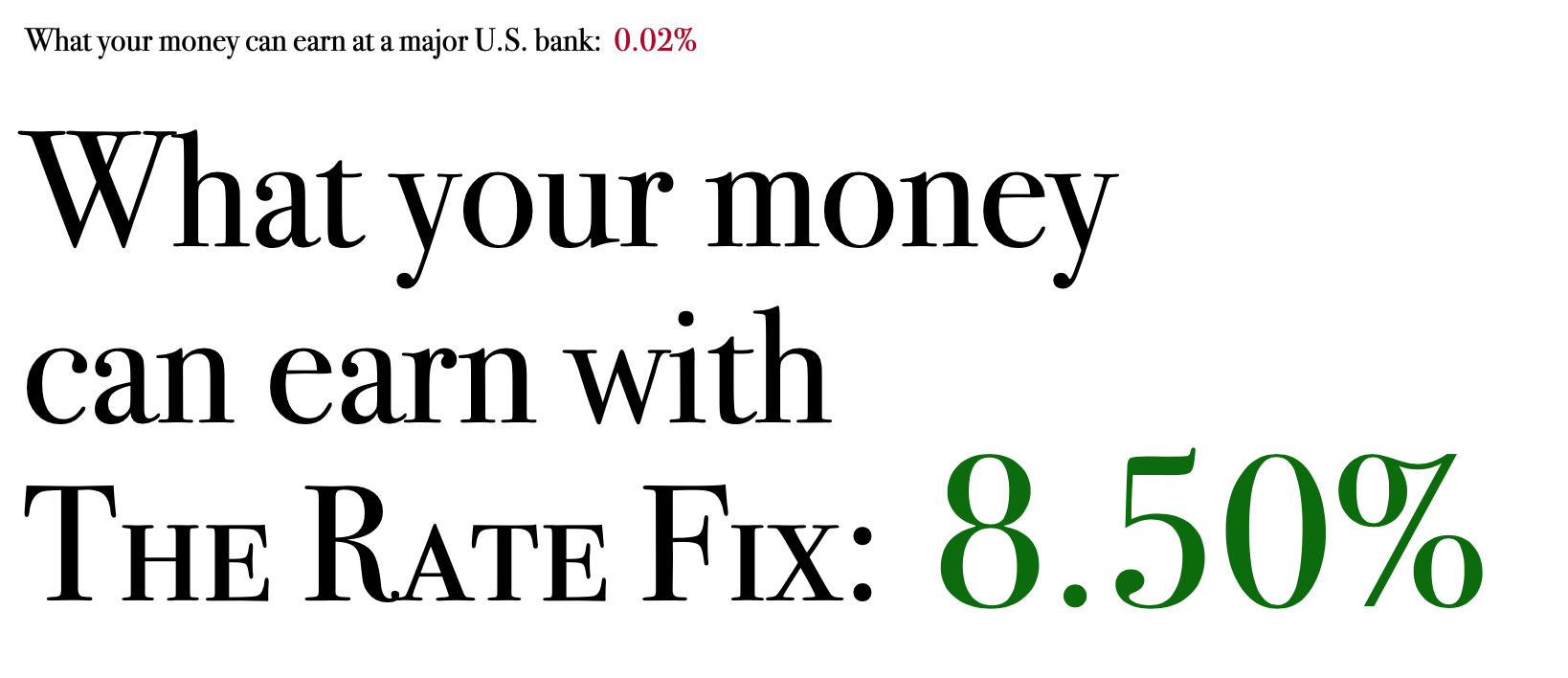

Here’s The Problem: Broken Rates

Many of us have a problem when it comes to our “extra” money:

Banks, credit unions, and even online resources are paying very low interest rates on most funds you may have deposited with them.

Many people are earning interest at a rate lower than the rate of inflation, and as a result, are losing money.

Their rates are broken.

We can fix that.

Scroll down to learn more about THE RATE FIX tag line, and how you can:

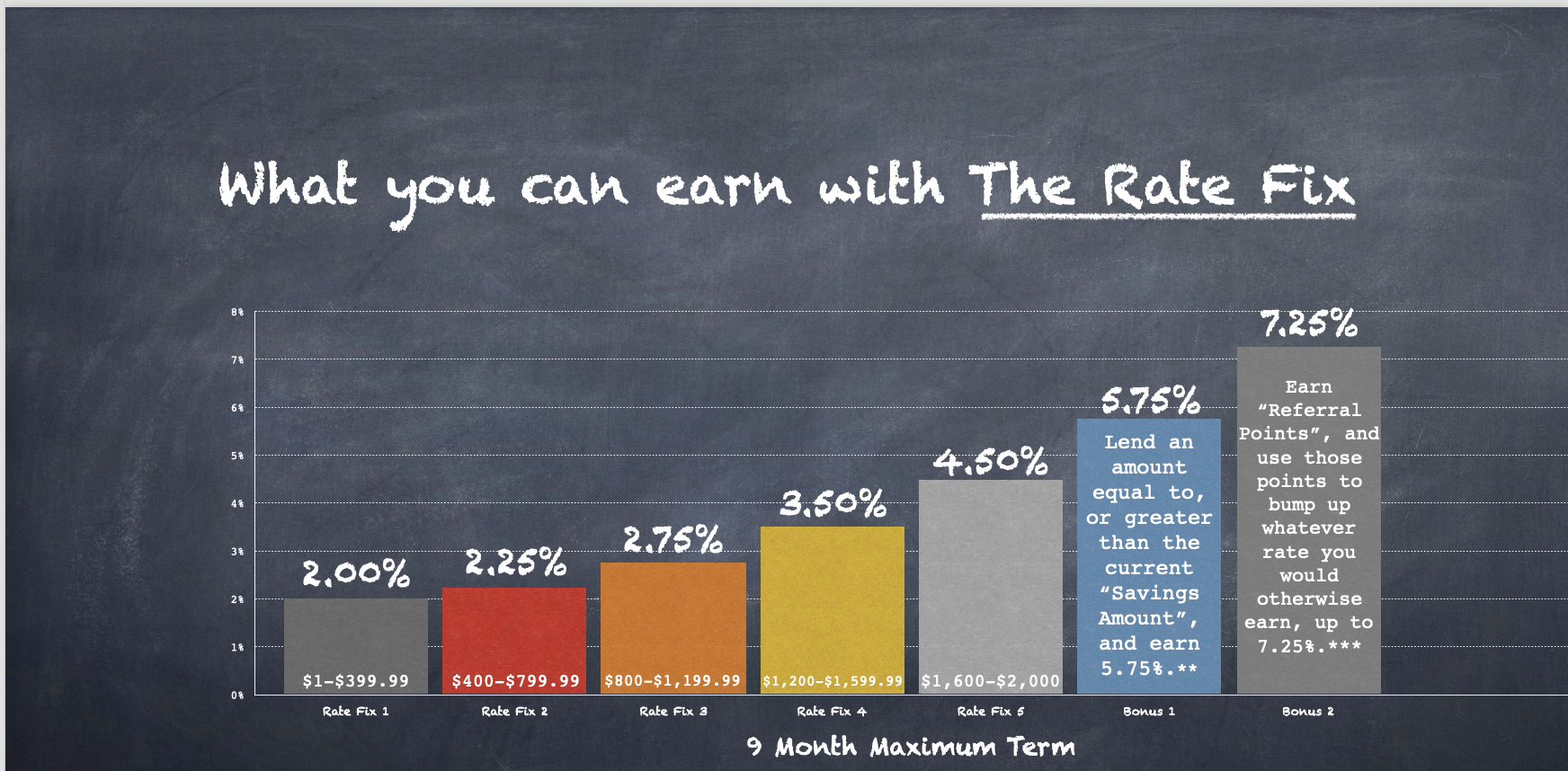

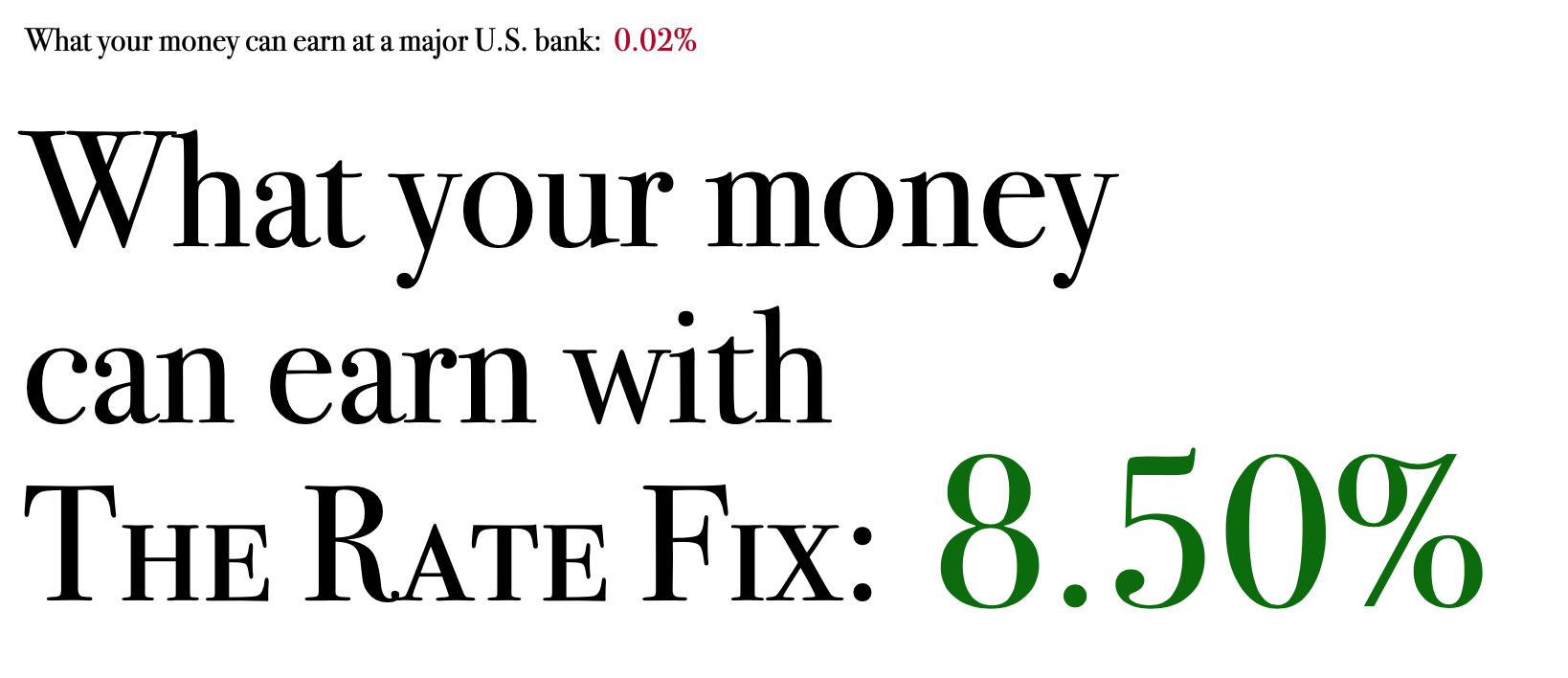

“Earn More.” (With 6 options, earn up to 8.50%)

“With Less.” (Start with just $10 if you’d like.)

“Faster.” (Terms from 3 months to 9 months. May be repaid sooner.)

bank, credit union and online offerings

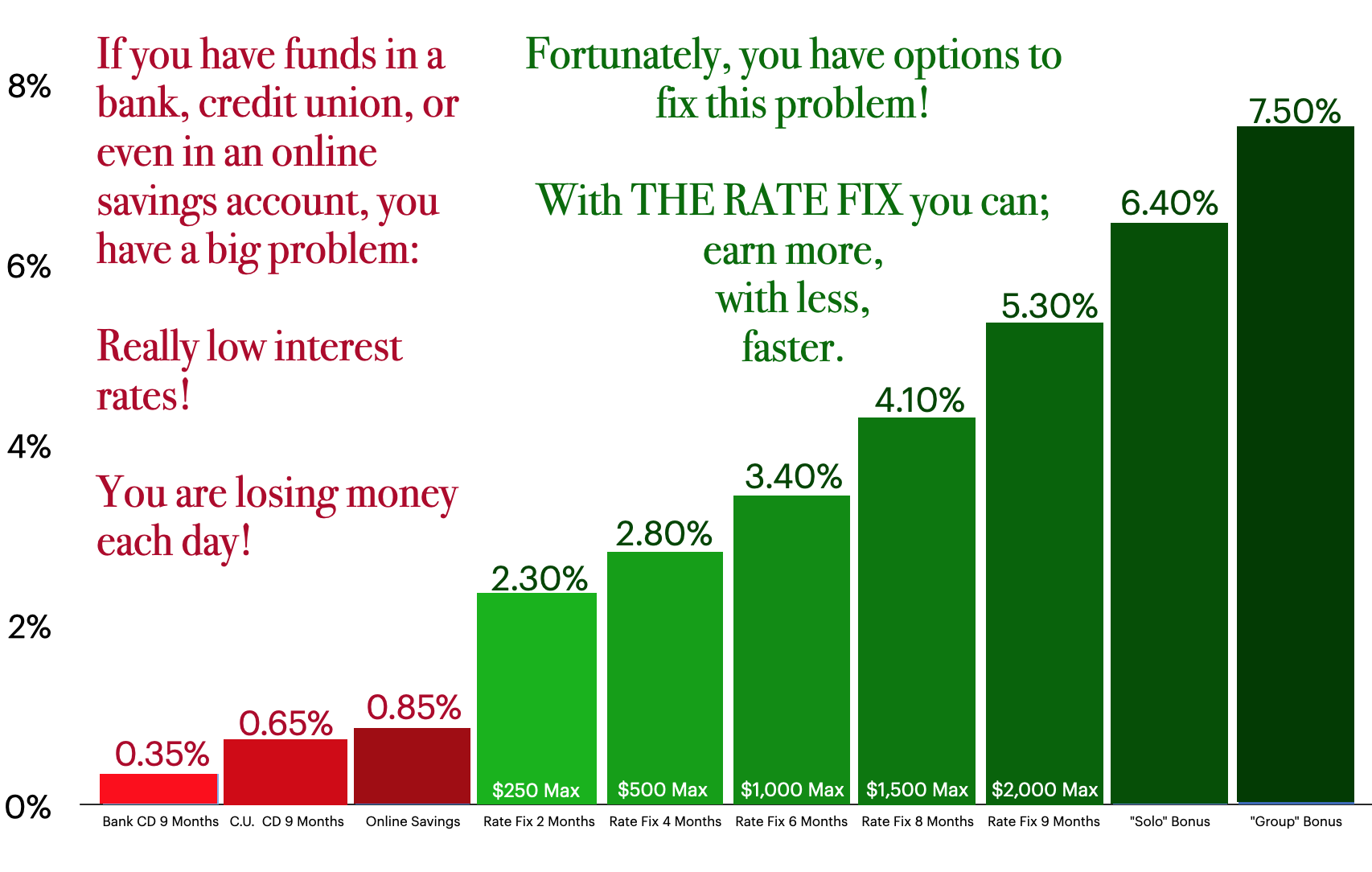

Below are some examples of the rates that banks, credit unions, and even online resources are currently offering.

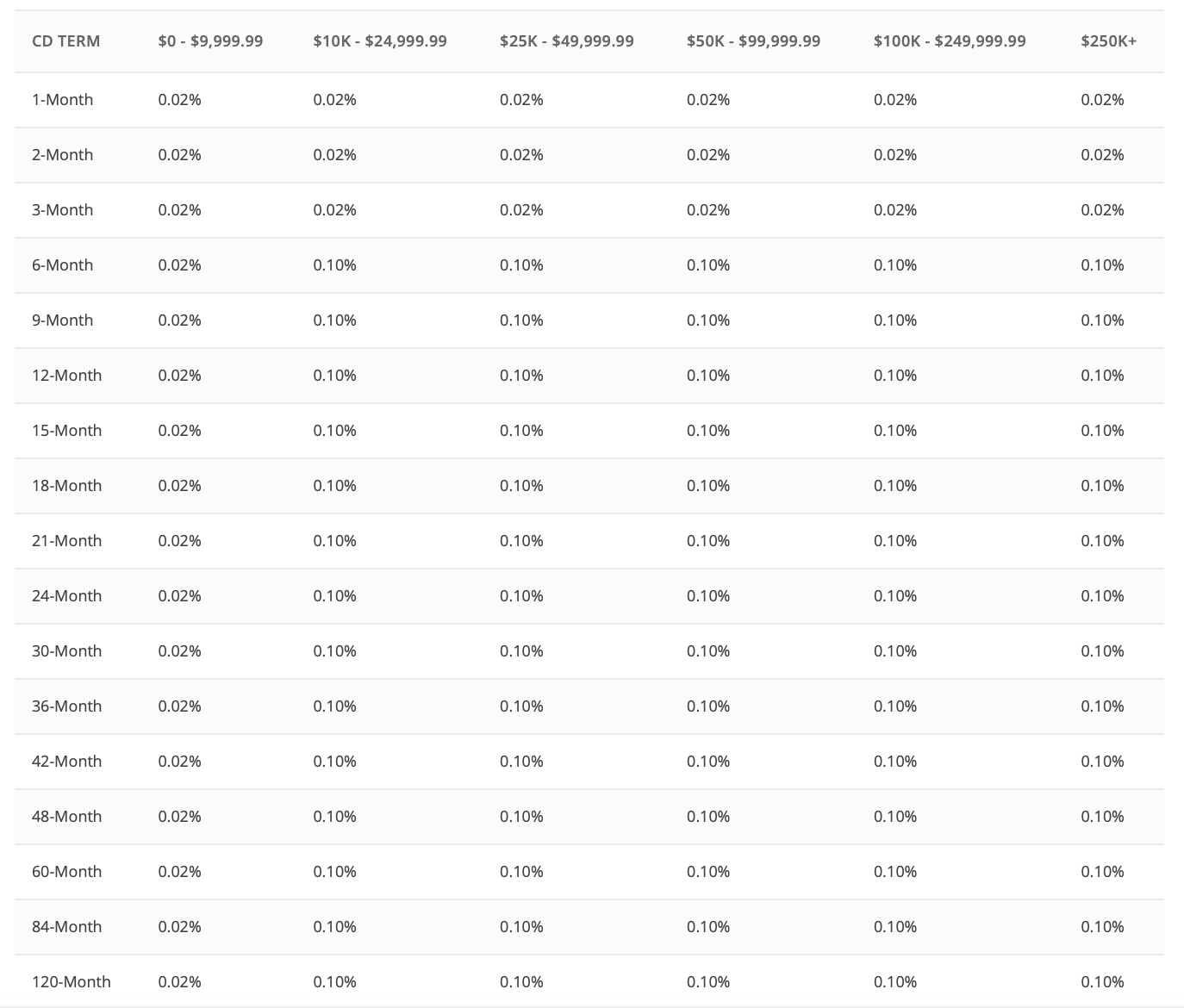

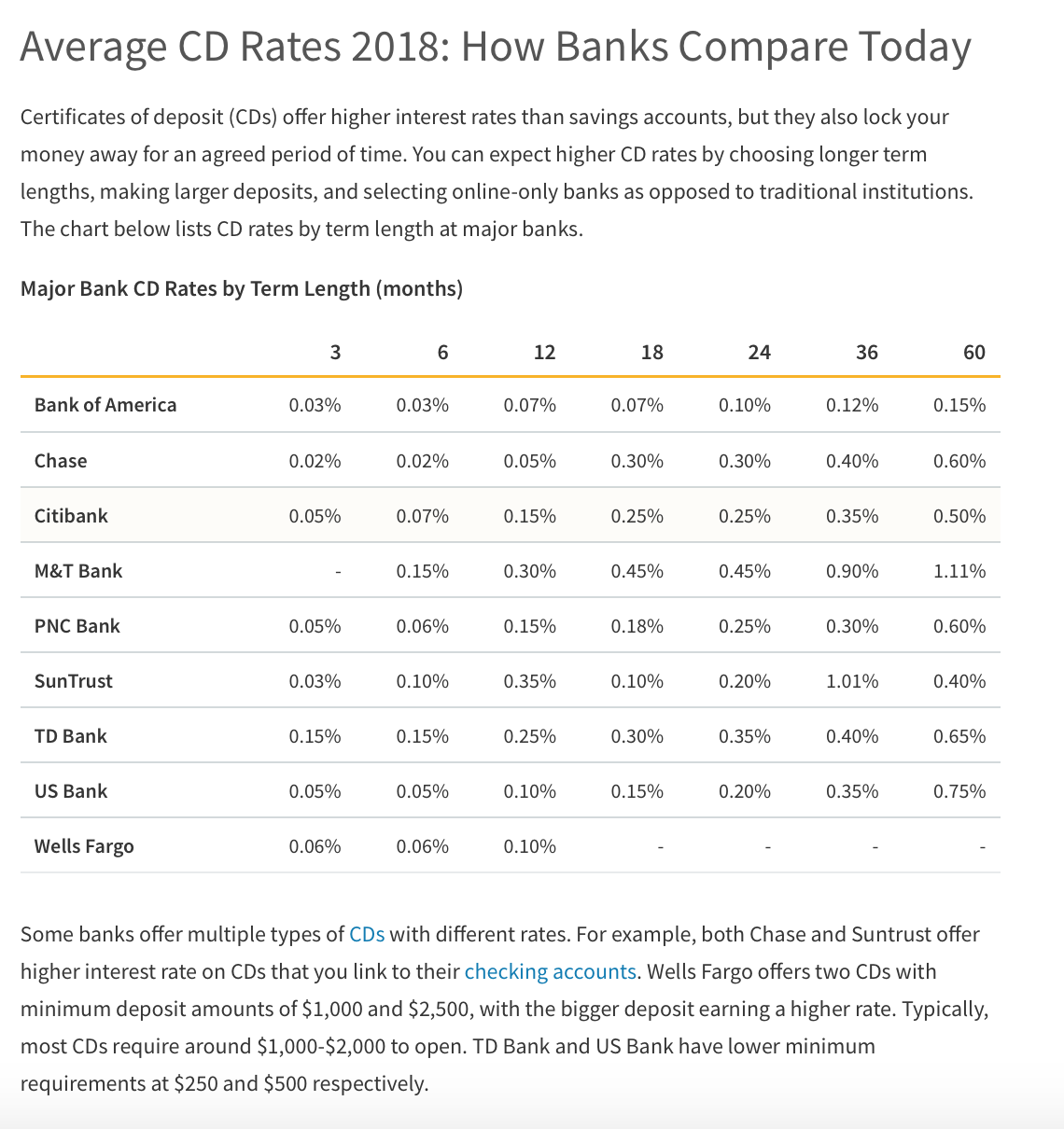

What banks are currently offering

the “dark-side” of historically low interest rates

While it’s great to get historically low rates on homes, cars, and other “big-ticket” items – the other side the interest rate “coin” is very low rates on savings accounts, checking accounts, and Certificates of Deposit. In fact, rates are so low right now, when compared to the current rate of inflation (2.0%) individuals are losing money!

BANKS

As the Federal Deposit Insurance Corporation’s (the people who insure deposits at banks) chart shows, the average rates offered from between 43,000 and 80,000 locations (“National Rate” column) are mostly below .50%!

The “Rate Cap” column represents the maximum rate allowed. (Or at least, the maximum rate the FDIC will insure.)

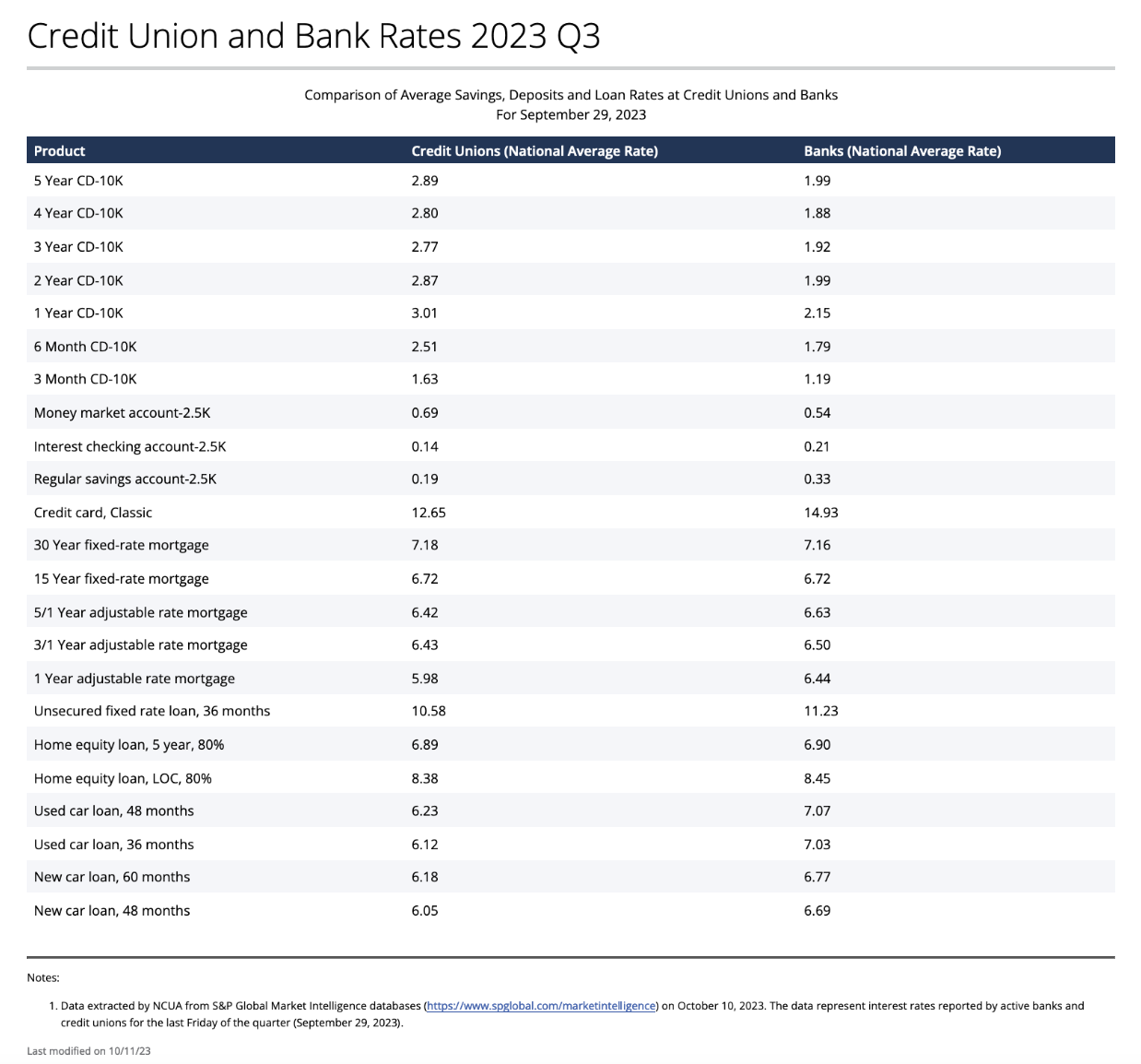

What CREDIT UNIONS are currently offering

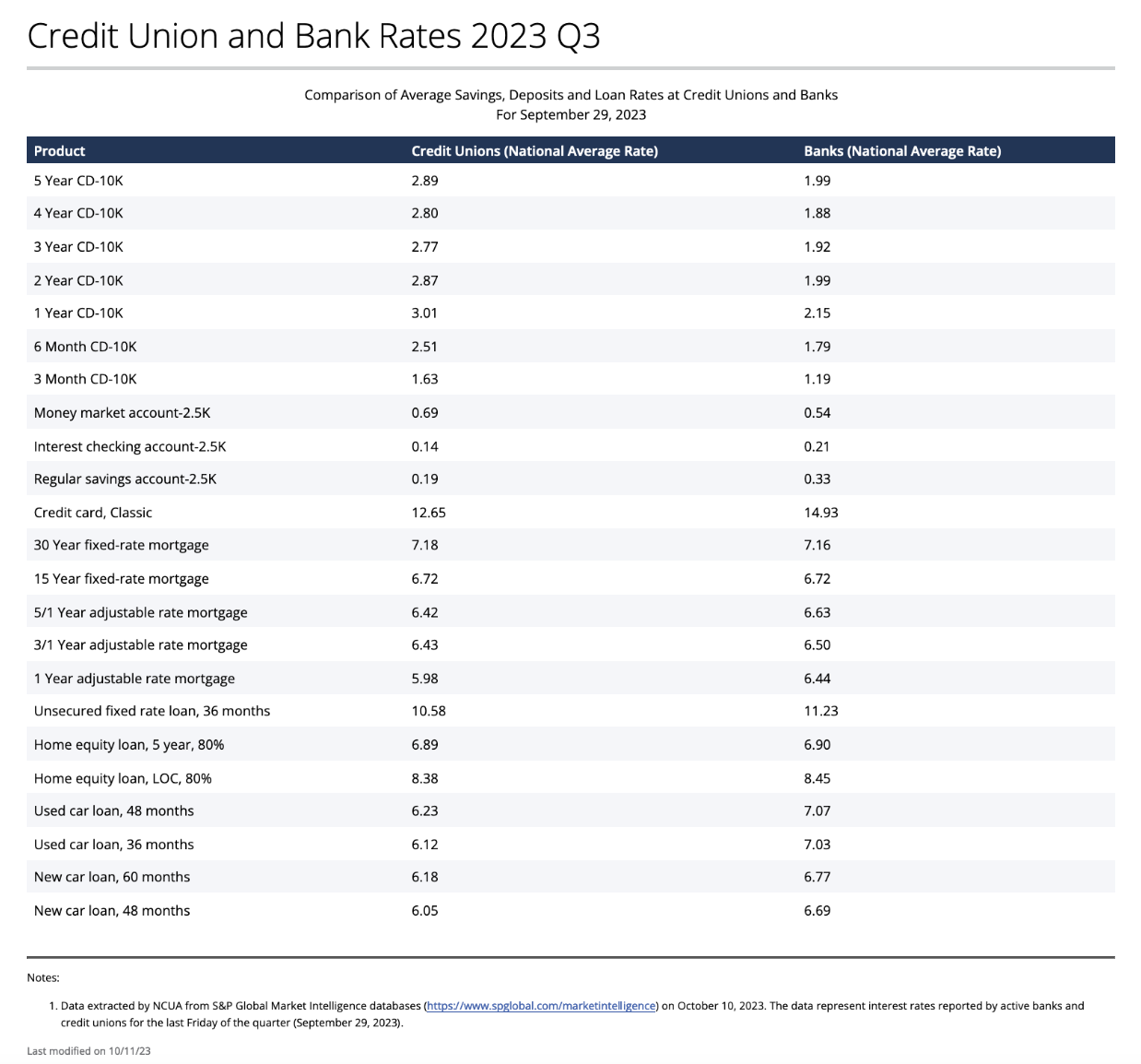

The table is a screen shot of the National Credit Union Association’s (NCUA) comparison between credit union’s rates vs. bank rates.

The NCUA insures credit union deposits.

The NCUA only puts out these comparisons on a quarterly basis, whereas the FDIC chart/info is put out weekly.

(Please note that the Certificate of Deposit (CD) rates are based on $10,000 deposits.)

Please check to see what the institution you may have funds deposited with are currently offering. Since these charts represent averages, it’s quite possible your particular bank or credit union is offering something higher.

(Your mileage may vary.)

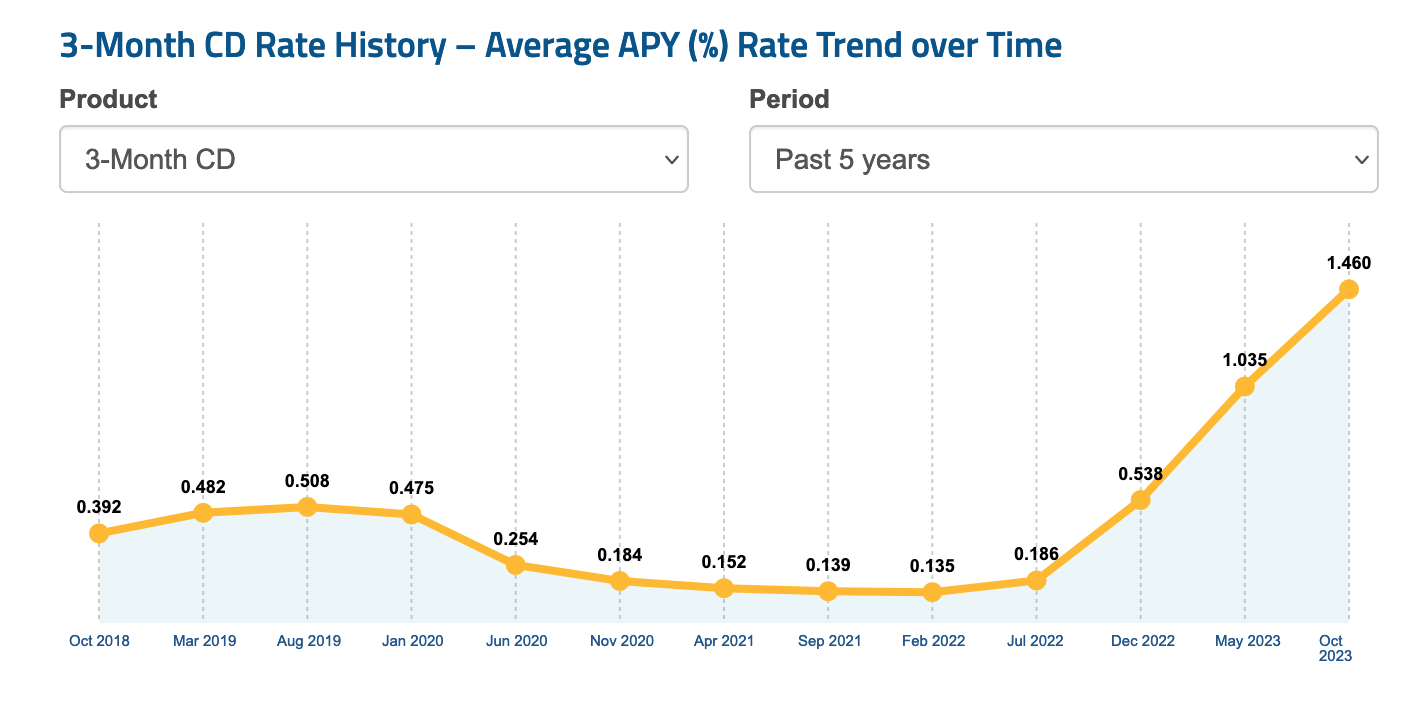

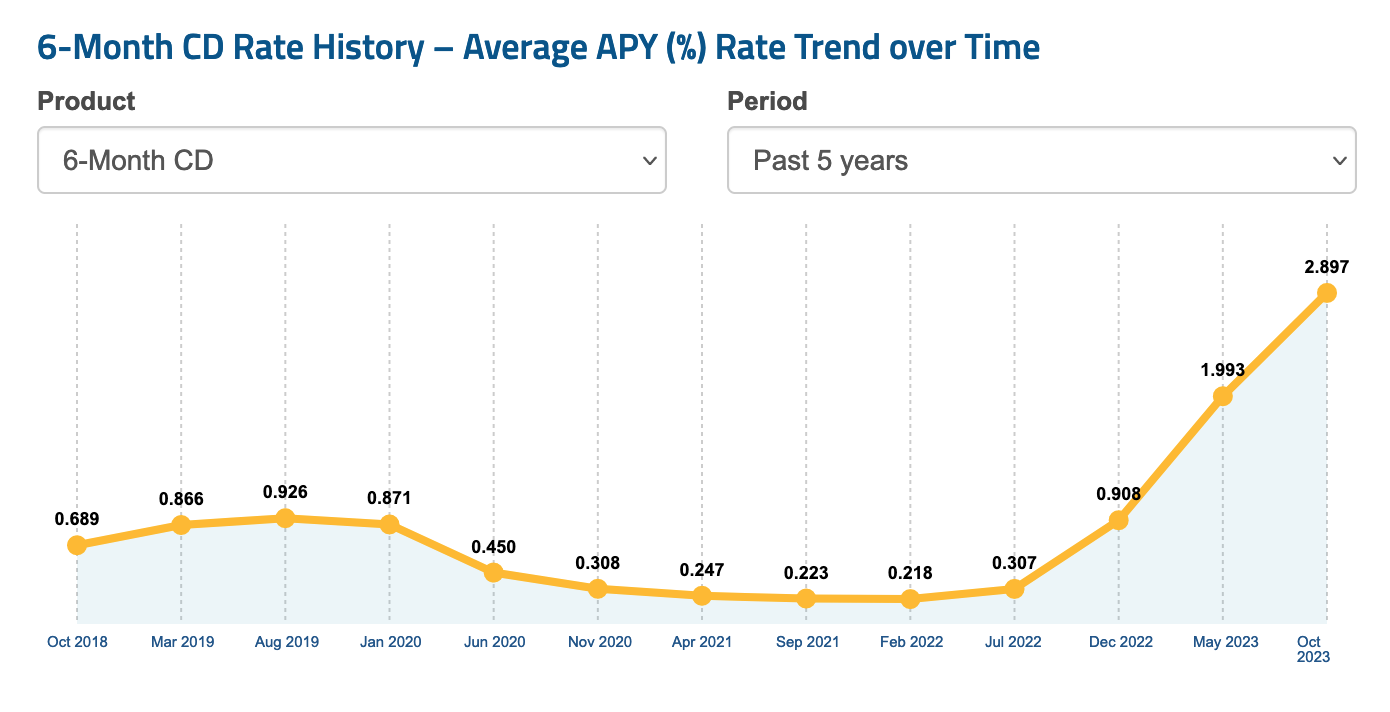

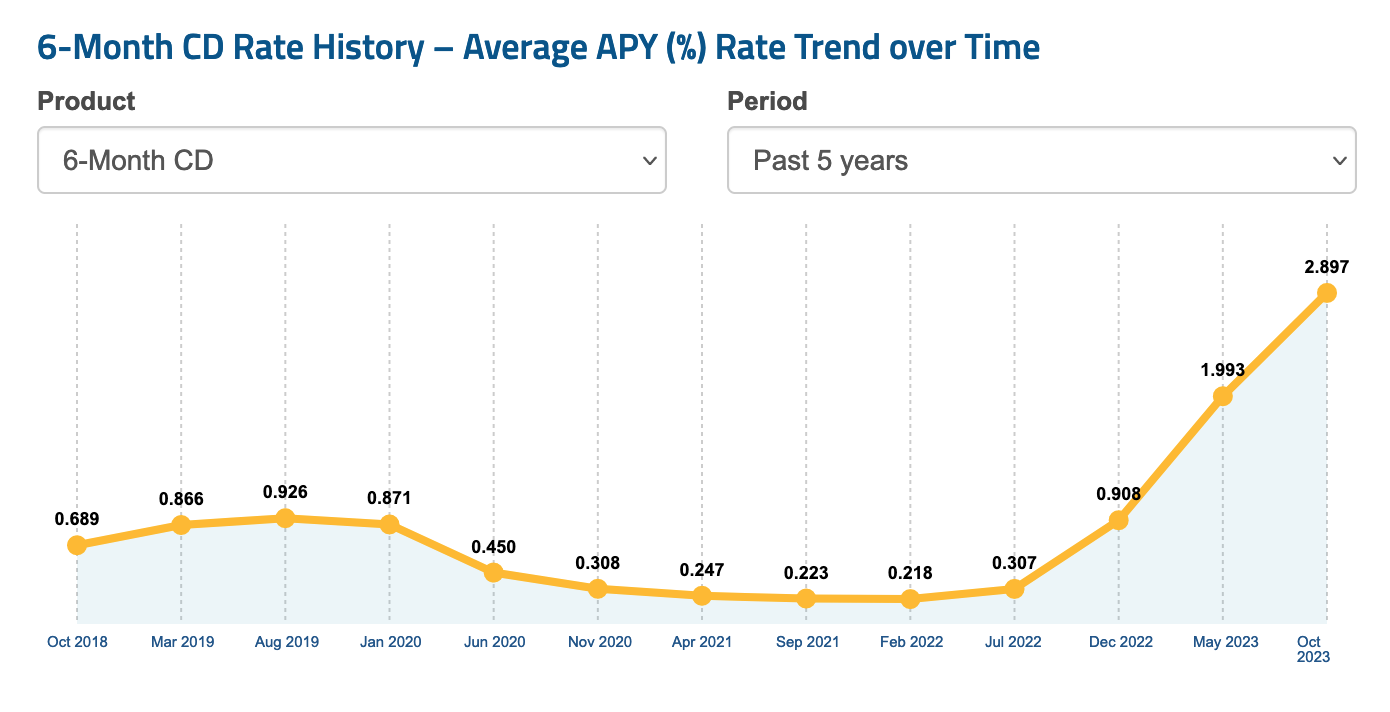

Here’s a chart from depositaccounts.com showing the trend of 1-Year CD Rates over the past 5 years.

You can see by this chart how the 6Month-CD Yield follows the movements of the Federal Funds Target Range.

ONLINE RESOURCES

There was a time (before the internet) when the only way one could maximize the interest rate return at a bank or credit union, they had to “lock in” a rate for chosen period of time. It could have been (as today) for 1 month, up to 5 or even 10 years with a Certificate of Deposit. (CD)

Today, with the internet, all that has changed! In addition to offering CDs, resources on the internet are currently offering saving accounts with rates that are higher than many CD rates! No need to “lock in” funds in a CD.

UFB Direct

1.35%

$5,000 Minimum

3.00%

$1 Minimum

Dollar Savings Direct

1.20%

$1 Minimum

The above 3 examples where found on Bankrate.com on 06/24/2020. These were among the highest rates on that date. Keep in mind that these resources pay Bankrate.com a fee to be included on this list. This particular list included 109 listings, (some resources had multiple listings) with rates as high as those listed above, all the way down to .02% with deposits from $500 to $25,000. The list bottomed out with a number of listings @ .01% with deposits from $1 to $100.

The average for the 109 listings was: .40% with a $105 minimum. (Yep. I have that kind of time!)

Earn More

Currently, you can earn up to 8.50% on your First 10 loans (strictly on your own).

6.40% (when you refer someone), and up to 7.50% (when getting involved with THE RATE FIX community!)*

These are much higher rates compared to the rates currently offered by banks, credit unions and online resources.

*Please click here for more detailed information on this.

Our minimum loan size is only $10!

We are more concerned with how long you are willing to lend your money, vs how much.

Therefore, our rates are based the term (3 months, 5 months, 7 months, and finally 9 months). The longer you are willing/able to temporarily part with your money, the higher the interest rate you will earn.

Faster

THE RATE FIX is asking for a time commitment from 3 months up to 9 months from individual lenders. However, loans could be repaid sooner than the selected term.

Maximize Your Returns

Learn how you can earn up to 8.50% on your FIRST 10 LOANS that you make to THE RATE FIX.

This is our way of simplifying your initial experience with THE RATE FIX. At the same time, it’s our way of saying “thank you” for giving us a try!

After the first 10 loans, you’ll be able to build upon your “start rate” by making referrals and earning “referral points”.

The value of these “referral points” is that they can be used to move from whatever rate you would otherwise qualify for, up to 8.50%!

About Us

THE RATE FIX is a new idea.

THE RATE FIX is a new idea in that our main goal is to make higher rates of returns available to more people.

How?

By allowing individuals who are NOT “accredited investors” the opportunity to earn higher rates of return with relatively small amounts of money. ($10, up to $500).

All while enjoying very short terms! (From 3 months, up to only 9 months! And the loans could get repaid even faster than that!)

(An “accredited investor” by the way, is an individual who earns at least $200,000 per year, or a married couple with a combined income of at least $300,000 per year, or have a net worth of at least $1,000,000 – not including primary residence, cars, etc. So, by most metrics that I’ve found, accredited investors make up somewhere between 1% to 5% of the U.S. population.)

The vast majority of investment vehicles that offer returns greater than those offered by banks, credit unions, and some online resources today only allow accredited investors. If they are offering securities (as deemed by the Securities and Exchange Commission – or the “S.E.C.”) most investment options are only allowed by law to work with accredited investors.

THE RATE FIX is designed for the other 95 to 99% in mind. (Oh, we’ll accept an accredited investor’s money if they’re interested! Their money is welcome! We’re just not actively going after accredited investors.)

Further, while we do not require you to be an accredited investor, you, as a lender, do not have to have 10’s of thousands of dollars in order to earn higher rates. In fact, you don’t even need hundreds of dollars to get started.

All you need is $10 to get started!

Story

The Idea Behind

The Rate Fix

Vivamus magna justo, lacinia eget consectetur sed, convallis at tellus. Quisque velit nisi, pretium ut lacinia in, elementum id enim. Vivamus suscipit tortor eget felis porttitor volutpat. Nulla quis lorem ut libero malesuada feugiat. Donec rutrum congue leo eget malesuada. Vivamus magna justo, lacinia eget consectetur sed, convallis at tellus. Curabitur aliquet quam Vivamus magna justo, lacinia eget consectetur sed, convallis at tellus. Quisque velit nisi, pretium ut lacinia in, elementum id enim. Vivamus suscipit tortor eget felis porttitor volutpat. Nulla quis lorem ut libero malesuada feugiat. Vivamus magna justo, lacinia eget consectetur sed, convallis at tellus.

Quisque velit nisi, pretium ut lacinia in, elementum id enim. Vivamus suscipit tortor eget felis porttitor volutpat. Nulla quis lorem ut libero malesuada feugiat. Donec rutrum congue leo eget malesuada. Vivamus magna justo, lacinia eget consectetur sed, convallis.

Vivamus Magna Justo

Vivamus magna justo, lacinia eget consectetur sed, convallis at tellus. Quisque velit nisi, pretium ut lacinia in, elementum id enim. Vivamus suscipit tortor eget felis

Vivamus Magna Justo

Vivamus magna justo, lacinia eget consectetur sed, convallis at tellus. Quisque velit nisi, pretium ut lacinia in, elementum id enim.

Vivamus Magna Justo

Porttitor volutpat. Nulla quis lorem ut libero. Vivamus magna justo, lacinia eget consectetur sed, convallis at tellus. Quisque velit nisi, pretium ut lacinia in, elementum id enim.

You Are Not Earning Enough

Banks, credit unions, and even online resources are paying much higher rates than a couple of years ago. However, they are still low interest rates compared to the compounded rates of inflation that have multiplied over the past few years.

You don’t have to accept them. You have options that offer much higher rates of return.

Get Started With Only $10

You can get started with just $10!

Referrals

THE RATE FIX only has a website presence. We are NOT on Facebook, Twitter, or any other social media. So, in an effort to grow, we are rewarding lenders who refer others to THE RATE FIX with the opportunity to earn a higher interest rate.

If you have any questions or concerns, please shoot me an email, or give me a call!

Decide if this idea is a good “fix” for you.

Read and review this website. The goal of this website is to make it as simple as possible for an individual to understand how they can benefit from what THE RATE FIX has to offer.

If you have any questions, please either call me at 760-441-7800, or shoot me an email to: [email protected]

How it Works

Our Approach

The goal of THE RATE FIX is to make higher rates of return available to more people, with relatively small dollar amounts. (At present, THE RATE FIX is only available to California residents who are at least 18 years old and who have at least $10 to a maximum of $2,000 to lend within a single loan.)

a way to earn even more

Community Partnership

This “Community Partnership” concept is based on the idea of the “community” benefiting from the collective actions of individuals.

How so?

Rewards for Hitting Milestones

OK, so the highest interest rate one can attain on their own is 5.25%. The idea is to “reward” the group of THE RATE FIX lenders with the opportunity to earn even higher rates of return.

How is this done?

I’ve set up a list of “milestones”, that once attained, will result in a bump up in the rate one can earn, in addition to what an individual might earn without it.

For example

Increases to the Max Rate Up to 8.50%!

So, since the maximum rate a lender can attain based on the “rate sheet”, is 4.75%, then the addition of a new lender to THE RATE FIX means that 8.50% will be available.

Contact

Get In Touch

If you have a question, concern, or need some clarification on something, please send me an email!

I get it.

This whole idea is a bit “out there” compared to what consumers are used to seeing from banks and credit unions.

That’s the whole point.

To create something you can’t just get anywhere else.

Site

Browse a page

Earn More

With Less

Faster

Shift Happens

What You Get

Contact

Get Started

Spread the word

THE RATE FIX is just getting started.

So we need your help: If you think earning a much higher interest rate than what banks, credit unions and online resources is a great idea, we need you to help to “spread the word”!

We are NOT using the usual social networks such as Facebook, Instagram, LinkedIn, YouTube, etc. – No social platforms at all.

We will be counting on current (and future) lenders to use “word of mouth” to share the benefits (higher interest rates) of lending to THE RATE FIX.

And to encourage the use of “word of mouth”, THE RATE FIX will reward those who do with higher rates of return on their money.

Story

Our Story & Mission

mentum id enim. Vivamus suscipit tortor eget felis porttitor volutpat. Nulla quis lorem ut libero malesuada feugiat. Donec rutrum congue leo eget malesuada. Vivamus magna justo, lacinia eget consectetur sed, convallis at tellus. Curabitur aliquet quam Vivamus magna justo, lacinia eget consectetur sed, convallis at tellus. Quisque velit nisi, pretium ut lacinia in, elementum id enim. Vivamus suscipit tortor eget felis porttitor volutpat. Nulla quis lorem ut libero malesuada feugiat. Vivamus magna justo, lacinia eget consectetur sed, convallis at tellus.

Vivamus Magna Justo

Vivamus magna justo, lacinia eget consectetur sed, convallis at tellus. Quisque velit nisi, pretium ut lacinia in, elementum id enim. Vivamus suscipit tortor eget felis

Vivamus Magna Justo

Vivamus magna justo, lacinia eget consectetur sed, convallis at tellus. Quisque velit nisi, pretium ut lacinia in, elementum id enim.

Vivamus Magna Justo

Porttitor volutpat. Nulla quis lorem ut libero. Vivamus magna justo, lacinia eget consectetur sed, convallis at tellus. Quisque velit nisi, pretium ut lacinia in, elementum id enim.

NEW

THE RATE FIX is new, so our repayments to date are not that impressive. . . . . .yet.

We’re just getting started. This whole idea just “went public” not long ago.

Average Return 8.50%

All individual lenders are earning at least 8.50%, as they are all lending under the “Everybody Earns At Least 8.50% For Their First 10 Loans!” program.

After the initial 10 loans, lenders will earn the interest rate assigned to the particular loan term the lender chooses.

Lenders can earn “Referral Points” each time they refer a new lender to THE RATE FIX.

Lenders can then use these points to “bump up” the rate they earn up to 8.50%, on their own.

Lenders can earn up to 8.50% again when they take part in the “Group Pricing”. (This is a bit involved, but you can read the full explanation by CLICKING OR PRESSING HERE.

Lenders can start with loans as small as $10.

The next decision will be to choose a loan term. Lenders can choose among 2,4,6,8 and 9 month terms.

How it Works

Our Approach

At THE RATE FIX, one of our goals is to keep things as simple as possible

simple, but not as simple as banks, credit unions and online resources

Just a bit more complex. While banks, credit unions, and online resources are currently offering extremely low interest rates, at least they’re relatively straightforward about it: Give them X amount of dollars for Y number of months/years, and you get Z interest rate in return.

Not as simple as the other guys, but not rocket science either.

At THE RATE FIX, there’s just a little bit more that goes into determining your interest rate. The interest rate you can earn is up to you for the most part.

you help determine the rate you can earn

“Community Partnership”

One of the aspects that makes THE RATE FIX different, is the idea of “Community Partnership”.

What’s that mean?

Contact

Get In Touch

Questions? Comments? Concerns? Send ’em over! Happy to get your feedback!

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

(I need to add some pithy content here!)

(I need to add some pithy content here!)

earn more

Welcome to The Rate Fix

THE RATE FIX was created to solve a problem by helping individuals earn a higher rate of return on relatively small amounts of money.

What’s the problem?

Most individuals are losing money every day.

How’s that?

Any funds an individual may have in a savings account, checking account, money market account, or a “Certificate of Deposit”, are most likely losing money.

What’s causing the problem?

Low interest rates.

Individuals are earning historic, or near historic low rates on any funds placed with a bank, credit union, or even online resources.

Rates are so low, they’re even lower than today’s supposedly “low” inflation rate of approx. 2%. The estimated 2% inflation rate means that in a year, the average cost of goods and services will be higher. So, a “basket of goods and services” that costs $2,000 today, will cost $2,040 in a year.

The “cost of living” that $2,000 will cover now, will cost $40 more this time next year. (Assuming the estimated inflation rate mainstains a constant level over 12 months. This rarely happens in real life, as the rate of inflation can move up or down, or up AND down, during any 12 month time-frame.)

If you have $2,000 in a bank Certificate of Deposit (the minimum amount required to open a “CD” at some banks or credit unions) earning .03% now, in a year, you will have $2,000.60.

That $2,000 earned just 60 cents in a year!

You just lost $39.40 in “buying power”. So people are actually losing money when compared to the annual rate of inflation.

Enough is enough.

Individuals need to earn a higher rate on their funds.

Individuals need to earn a higher rate not only to “keep up” with inflation, but people need to “get ahead” of the rate of inflation.

THE RATE FIX is designed to fill that need.

(In a year, $2,000 placed with THE RATE FIX @ 6.300% would grow to $2,126. A gain of $86 over the impact of 2% inflation.)

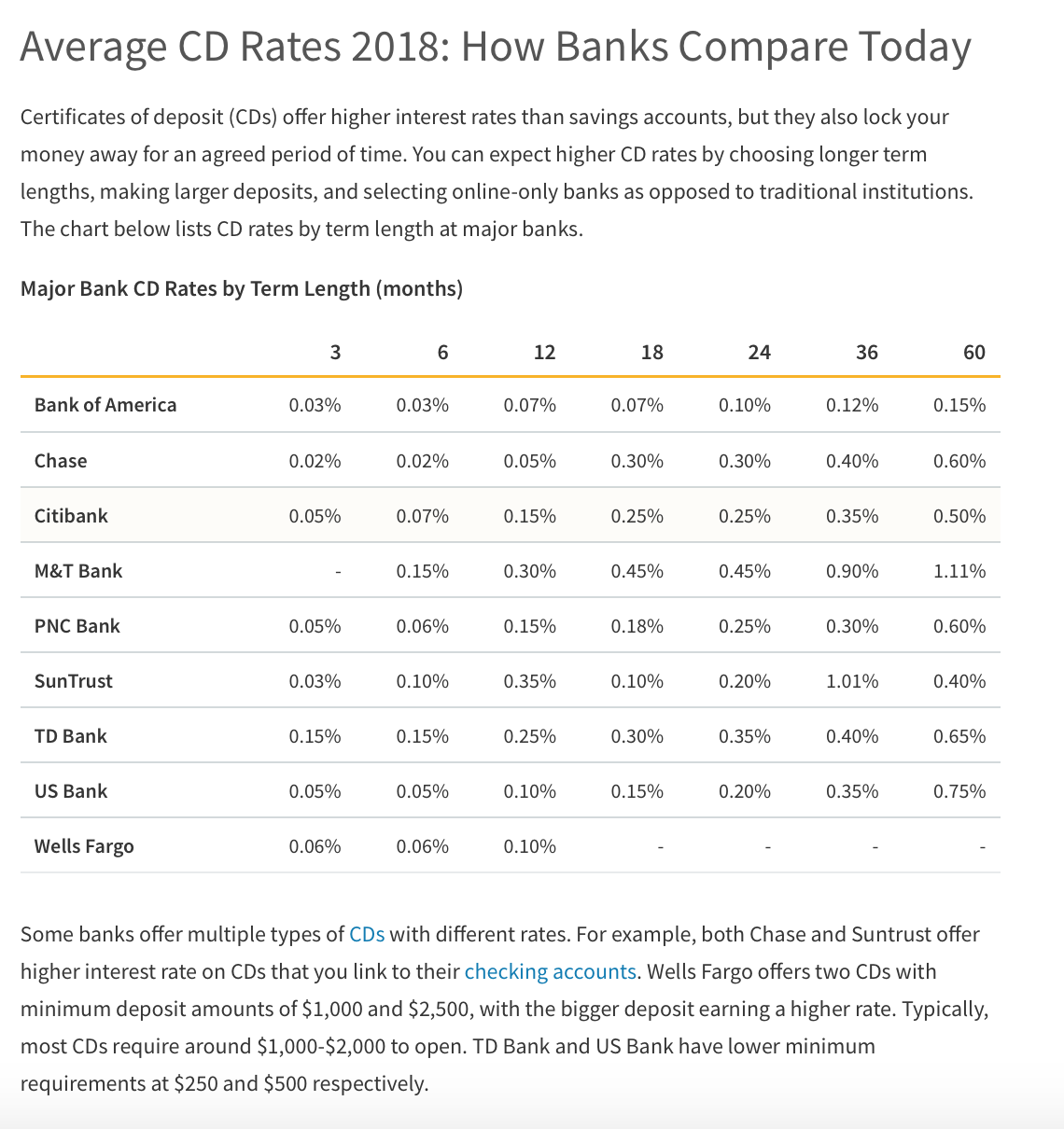

Here’s a chart showing the current rates offered by some of the largest U.S. banks as of November 9, 2018. (Information found on valuepenguin.com)

Earn up to 7.50%.

How can I offer such a high rate when banks are offering rates well below 1% and credit unions are offering rates below 2% and some online resources are offering only 1.24% on their 9-month Certificates of Deposit?

Sounds too good to be true right?

Am I using borrowed funds to:

- Purchase a profitable “fix and flip” real estate deal?

- Buy a bunch of Bitcoin or some other “crypto-currency”?

- Buy stock in the latest “can’t miss” internet start-up?

- Taking the money to Las Vegas and doubling the money with the latest “Beat Vegas” gambling idea?

No.

What I’m doing is really not very exciting. Actually, it’s pretty boring.

But it’s really simple.

I’m looking to individuals to lend funds to pay-down, and eventually pay-off a line of credit.

Not boring enough?

That line of credit is being used to pay off debt. (Be still my heart, right?)

You might be asking yourself about now: “Why go to all this trouble to pay-down, and eventually pay-off some debt?

Good question.

The corporate debt is less than $15,000.

However, there are a few benefits for doing this:

- Gives individuals an opportunity to earn up to 7.50% with small amounts of money.

- This simply shifts debt payments from going to corporate giants to individuals. The monthly payments are going to be made anyway, the idea is to shift payments from the credit line to individuals. Why not give people who know me the chance to earn 7.50%?

- This corporate debt, while relatively small in the larger scheme of things, carries interest rates ranging from 13.99% up to 18.50%

- This process can serve as a “proof of concept”, or a way of “testing the waters”. Simply, a way to put this business idea “out there”. As if to say, “Look. Here’s what I’m doing. Here’s my idea. Here’s the benefit to you. Here’s how much (or how little) money you need to get that benefit. Are you interested?”

STEP ONE

This is only “Step One” to see if there’s enough interest on the part of enough individuals to pay this initial debt amount.

If so, we can move on to “Step Two”. (I won’t bother sharing “Step Two” until “Step One” is complete. No need to “pile on” more information about something that may not happen.)

If there aren’t enough individuals interested in earning 7.50% through this little idea, then, oh well. No harm, no foul – and I learned a few things in the process.

With Less.

You can get started with just $10.

I get it.

THE RATE FIX is a new idea few people have heard of, with a very limited history. But with this idea of allowing lenders to start with just $10, people can get started and try us out, without risking a lot of money.

Faster.

I’m asking individuals for a time commitment from 3 months, up to a maximum of 9 months.

However, your loan should be paid back sooner than that.

"Bumps" to the Interest Rates

You can directly impact the interest rates that not only you can earn, but you’ll also be positively impacting the rates anyone else can earn.

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

You've already made a loan to THE RATE FIX, and you refer your next door neighbor: Both you and your neighbor earn "Referral Points"

#7: 30 Days, 23 Hours. +.05 for NEW LENDER

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

#6: 31 Days, 0 Hours. +

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

#5: +.10 - New Lender - 5.35%

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

#4: 31 Days, 0 Hours +.10 - New Lender - 5.35%

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Your Title Goes Here

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

This is where I can add some information to help clarify what THE RATE FIX is doing and how lenders can benefit.

Helping Individuals Earn A Higher Return Since The Day Before Yesterday!

THE RATE FIX is just getting started. Our goal is to help individuals earn a much higher return than they can through options available at banks, credit unions, and online resources.

Join Our Newsletter

Why Work With The Rate Fix?

Curabitur Aliquet Quam

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero.

Vestibulum Ante

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero.

Cras Ultricies Ligula

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero.

Eget Tincidunt

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero.

Ipsum Primis

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero.

Quam Vehicula

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero.

Arcu Erat

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero.

Sed Porttitor

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero.

Lender Stats

23

CURRENT, ACTIVE LENDERS

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero malesuada feugiat. Vestibulum ante ipsum primis in

$76.89

AVERAGE LOAN SIZE

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero malesuada feugiat. Vestibulum ante ipsum primis in

8.2%

AVERAGE LENDER RATE OF RETURN

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero malesuada feugiat. Vestibulum ante ipsum primis

Why was THE RATE FIX created?

THE RATE FIX is designed to offer a “win-win” for those who make loans to THE RATE FIX, and myself.

The idea is simple: I am refinancing existing debt that is carrying a higher interest rate, with funds from individual lenders at a lower rate.

Individuals who elect to lend funds will earn a much higher rate of return on relatively small amounts of money than they might earn through a bank or credit union. (The “win” for individual lenders is that they earn a higher rate of return, so they earn more money.)

The “win” for me is that this saves me money.

How is the maximum rate determined?

By using the current U.S. Prime Rate which as of May 3, 2023 – after a .25% increase – stands at 8.25%.

Donec rutrum congue leo eget malesuada?

Sed porttitor lectus nibh. Praesent sapien massa, convallis a pellentesque nec, egestas non nisi. Cras ultricies ligula sed magna dictum porta. Donec rutrum congue leo eget malesuada. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec sollicitudin molestie malesuada. Sed porttitor lectus nibh. Cras ultricies ligula sed magna dictum porta. Quisque velit nisi, pretium ut lacinia in, elementum id enim.

Quisque velit nisi, pretium ut lacinia in, elementum?

Sed porttitor lectus nibh. Praesent sapien massa, convallis a pellentesque nec, egestas non nisi. Cras ultricies ligula sed magna dictum porta. Donec rutrum congue leo eget malesuada. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec sollicitudin molestie malesuada. Sed porttitor lectus nibh. Cras ultricies ligula sed magna dictum porta. Quisque velit nisi, pretium ut lacinia in, elementum id enim.

Contact

Get In Touch

If you have a question or comment, please fire off an email!

The Rate Fix

Currently, THE RATE FIX does NOT have a presence on any social media platform.

Not one.

Why?

A few reasons:

Sounds like a lot of work for starters!

Secondly, many if not most of these platforms have the ability to change their algorithms at any time, often without notice, thus impacting (for better or worse) what one can do on the platform.

And also, privacy. As per these platforms, what is done on them becomes their property. Who knows what these platforms are doing with all of that information in addition to selling your information to companies who might want to advertise to you.

While one of the goals here at THE RATE FIX is to “get in front” of more people, we don’t need millions of “views” or 10’s of thousands of “users/customers/clients”. Our intent is to grow this idea as “organically” as possible by promoting “word of mouth” from existing lenders. (See more details about my thoughts about the eventual size of this idea here.)

8.50%

Share, and Earn More

Share THE RATE FIX with anybody you think would be interested, and you help push the interest rate everybody can earn upward, to a maximum of 8.50%!

Why Work With

THE RATE FIX?

Curabitur Aliquet Quam

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero.

Vestibulum Ante

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero.

Cras Ultricies Ligula

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero.

Eget Tincidunt

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero.

Ipsum Primis

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero.

Quam Vehicula

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero.

Arcu Erat

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero.

Sed Porttitor

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero.

Earn Up To 8.50%

8.50%

FIRST 10 LOAN FOR NEW LENDERS

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero malesuada feugiat. Vestibulum ante ipsum primis in

5.50%

New Lenders

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Nulla quis lorem ut libero malesuada feugiat. Vestibulum ante ipsum primis in

.05%, .10%, .15%, and .20%

Add these fractional amounts to 5.50% to earn up to 7.25%

With your help (referrals) you have direct impact on the interest rates you can earn.

With your referrals, you can push the interest rate everyone can earn (when using their “Referral Points”) up to a maximum of 7.25%.

Our lender base has grown over 100% in one month!

James Doe

Fred in Carlsbad referred his next door neighbor.

.05% BUMP TO RATE

Referred Next Door Neighbor

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

NEW RATE

=

7.50%

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Days Untii Christmas 2023

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

31 DAY TIMELINE

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

So, this content in the module Design settings and text in the module Advanced settings.

JOHN REFERRED ALICE

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)